KRA Individual Income Tax Returns 2020

Every individual/person in Kenya with a KRA (Kenya Revenue Authority) PIN (Personal Identification Number) is required to file annual tax returns. Failure to file returns and/or pay the Income Tax before 30th of June the following year attracts a penalty as follows;

KRA Tax Penalties

Late Tax Payment: “5% of the tax due plus a late payment interest of 1% per month on the unpaid tax until the tax is paid in full.”

Late Returns Filling: Kshs 2,000

What is KRA Individual Income Tax Returns?

This is a declaration of income earned (in Kenya) by an individual (whether a resident or non-resident) within a particular year.

When to file

KRA Individual Income Tax Returns for a particular year can be filled between January 1st and June 30th of the following year.

Step by step process on How to File NIL KRA Tax Returns 2020

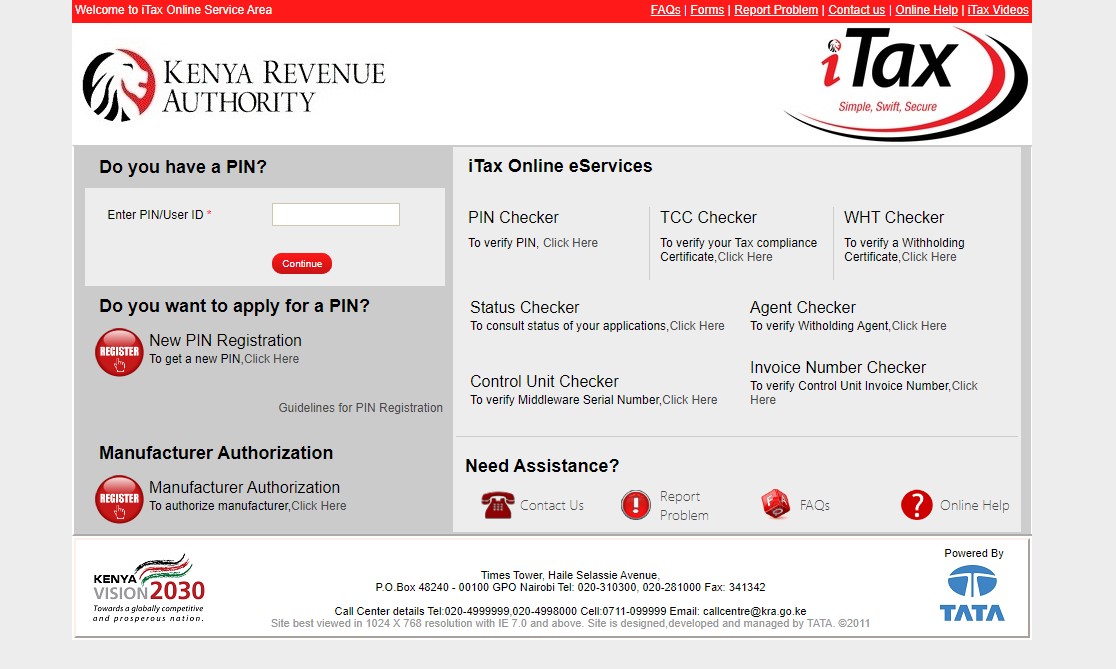

- Go to KRA’s iTax Portal – https://itax.kra.go.ke/KRA-Portal

- Login to your iTax profile by entering your Pin/User ID, Password and Solving the Security Stamp.

- On the Navigation menu, hover on Returns and Click on File Nil Return.

- In the Nil e-Return, there is a Tax Obligation tab with three drop-down income tax options. Select the one that best suits you (Resident Individual, Non-Resident Individual or Rent Income).

- Enter the tax return period, your wife’s Pin (If Married) and then click Submit.

- Once you click submit, you will receive an acknowledgment notification and a receipt. For your own future record, you can download the receipt.

How to File Individual Income KRA Tax Returns 2020

If you have an income tax to declare, follow the steps below to file your returns and make the tax payment.

- Visit the KRA’s iTax Portal – https://itax.kra.go.ke/KRA-Portal

- Log in to your iTax profile by entering your Pin/User ID, Password and Solving the Security Challenge.

- On the Navigation menu, hover on Returns and Click on File Return.

- Download and Fill in the Return Form (Excel or ODS).

- Enter the required information in the Online Form.

- Upload the filled form.

- Check the button to agree with the Terms and Conditions.

- Click Submit.

- On filing the Returns, a receipt will be generated together with an acknowledgment message “return submitted successfully along with acknowledgment number”.

How to Pay KRA Individual Income Tax 2020

Once you file your tax returns, generate and download the payment slip and pay using either of the following methods.

- Visit a KRA appointed bank with the payment slip and pay the amount indicated.

- Pay using Lipa Na Mpesa Paybill Number

-

- KRA Pay Bill Number: 572572

- Account Number: “Payment Registration number quoted at the top right corner of the generated payment slip.”

At Treasured Consulting Limited we offer Tax Return Services for both Individuals and companies. Contact us for more information.

Contact Details

Feel free to interact with us today. Send us any questions or comments.

Call Us: +254 712 464 727

Send Email: info@treasuredconsulting.co.ke

Twitter: Treasured Kenya

Facebook: Treasured Consulting